- Exchange-traded funds provide many potential advantages when used to access active strategies.

- When considering switching to an active fixed income mutual fund’s ETF counterpart, be sure to conduct due diligence to see if they truly align.

The rise of active fixed income ETFs: What you should know

Over the past decade, financial advisors have increasingly favored ETFs and their characteristics for accessing active strategies. It’s easy to see why.

Compared with mutual funds, ETFs offer distinct advantages, including ease of trading and implementation owing to their exchange-traded nature, as well as the potential for lower all-in costs through reduced trading expenses and, in some cases, lower expense ratios. With that backdrop, it’s no surprise that active managers across equities and fixed income have gravitated toward the ETF wrapper to match these preferences. Within fixed income, we have seen a rapid adoption of active ETFs, which account for more than 40% of the cash flow over the past year and represent nearly 20% of total assets invested in fixed income ETFs.1

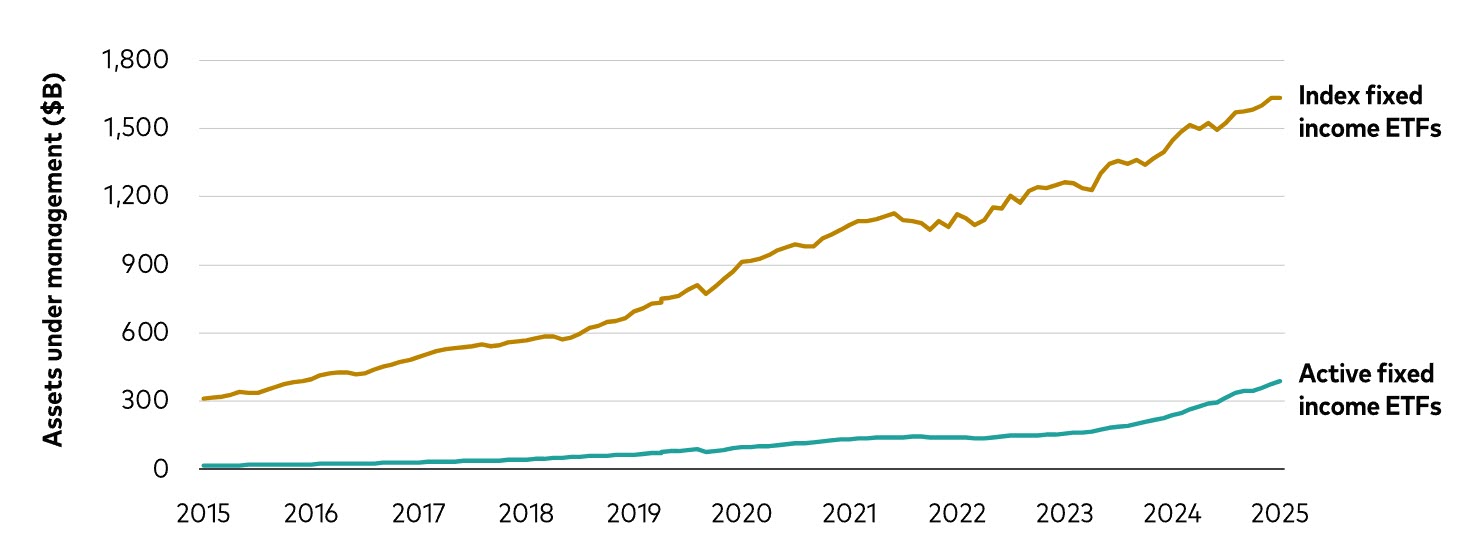

Figure 1: Active and passive bond ETFs: A tale of two adoption curves

Fixed income ETF assets under management July 2015-July 2025

Source: Morningstar data, as of July 31, 2025

Due diligence required for active fixed income ETFs

Over the past decade, the number of active ETFs available has surpassed the number of index ETFs, with some active strategies attempting to mirror existing mutual funds from asset managers.1 A key theme emerging in recent conversations is advisors adopting these ETF “siblings” of mutual funds that they know and allocate to in their model portfolios. At the same time, our discussions with advisors have revealed a handful of challenges, including unexpected investment outcomes, when assuming the ETF is equivalent to the mutual fund. To take the sibling analogy a step further: These products can range in similarity from near twins to cousins. When assessing these products, we encourage advisors to consider these three due-diligence questions:

- How is the ETF similar to or different from the mutual fund?

- If it is different, how meaningful are the deviations?

- How will those deviations influence the strategy’s performance?

While the ETF may seek the same objectives, fit in the same category, and even share a common name, material differences may exist that could easily be missed without proper due diligence. Some of the common differences we see include:

- Portfolio management. Portfolio management team, philosophy, process, exposures, and risk-budget may all differ between the ETF and mutual fund. This is the first thing to check to ensure the ETF is actually an equivalent product. Any differences in these categories can create meaningful performance differences from the mutual fund and require a fresh approach to due diligence.

- Issuer’s experience running ETF portfolios. There are material differences in operating ETFs and mutual funds, including those highlighted here. ETFs require a different set of operational requirements than mutual funds, and those requirements take time, expertise, and experience to master. Make sure your provider has a track record in this space.

- Performance. If the team, process, and provider all check out, performance can validate whether the ETF truly aligns with its mutual fund counterpart. But remember that past performance isn’t a prologue—it’s simply a clue. Use it as part of a broader due diligence lens.

Potential solutions to consider

As ETF adoption accelerates, the temptation to swap a mutual fund for its “equivalent” ETF will only grow. But don’t assume equivalence—verify it. Make sure the ETF is managed by the same team, follows the same philosophy, and is backed by a provider with proven expertise in fixed income ETF management.

At Vanguard, we've been managing fixed income ETFs since 2007 and offer ETF versions of several active mutual fund strategies that are substantially similar in management team, approach, and execution. Examples include Vanguard Core Bond ETF (VCRB), Vanguard Core-Plus Bond ETF (VPLS), and Vanguard Multi-Sector Income Bond ETF (VGMS).

If you're considering making a switch or simply want to understand how Vanguard approaches active fixed income ETFs, reach out to your Vanguard representative for more information.

[1] Morningstar data as of July 31, 2025.

Notes:

- For more information about Vanguard funds or Vanguard ETFs, view detailed product information or call 800-997-2798 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

- Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.

- All investing is subject to risk, including possible loss of principal. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account.

- Vanguard is not responsible for determining what's in the best interest of any underlying client on whose behalf you use this information. As an investment advisor, it remains your responsibility to make a best-interest determination for your clients, so you should review carefully the information presented and the fund's prospectus for more complete information regarding any fees, expenses, investment objectives, and risks, and make your own determination as to its appropriateness before you rely on it.

- Bond funds are subject to interest rate risk, which is the chance bond prices overall will decline because of rising interest rates, and credit risk, which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer's ability to make such payments will cause the price of that bond to decline.

- CFA® is a registered trademark owned by the CFA Institute.

· Data provided by Morningstar is property of Morningstar and Morningstar’s data providers and it should therefore not be copied or distributed. Morningstar and its data providers are not responsible for any certification or representation with respect to data validity, certainty, or accuracy and are therefore not responsible for any losses derived from the use of such information.

- Vanguard Mexico is not responsible for and does not prepare, edit, or endorse the content, advertising, products, or other materials on or available from any website owned or operated by a third party that may be linked to this email/document via hyperlink. The fact that Vanguard Mexico has provided a link to a third party's website does not constitute an implicit or explicit endorsement, authorization, sponsorship, or affiliation by Vanguard with respect to such website, its content, its owners, providers, or services. You shall use any such third-party content at your own risk and Vanguard Mexico is not liable for any loss or damage that you may suffer by using third party websites or any content, advertising, products, or other materials in connection therewith.

- The sale of the VCRB, VPLS and/or the VGMS qualifies as a private placement pursuant to section 2 of Uruguayan law 18.627. Vanguard represents and agrees that it has not offered or sold, and will not offer or sell, any VCRB, VPLS and/or the VGMS to the public in Uruguay, except in circumstances which do not constitute a public offering or distribution under Uruguayan laws and regulations. Neither the VCRB, VPLS and/or the VGMS nor issuer are or will be registered with the Superintendency of Financial Services of the Central Bank of Uruguay to be publicly offered in Uruguay.

The VCRB, VPLS and/or the VGMS correspond to investment funds that are not investment funds regulated by Uruguayan law 16,774 dated 27 September 1996, as amended.