Este artículo está disponible sólo en inglés.

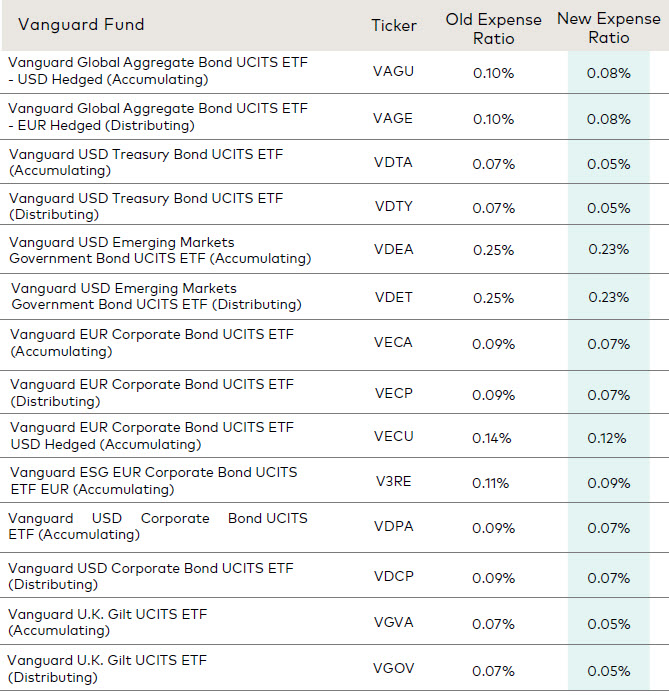

Effective July 1st 2025, we are reducing fees across seven of our fixed income UCITS ETFs, spanning 26 share classes. The fee cuts will result in some of the lowest-cost ETFs tracking core fixed income exposures such as global bonds, US Treasuries, emerging market government bonds and euro- and US dollar-denominated corporate bonds, including hedged share classes.

In investing, you get what you don’t pay for. Lower costs leave more money in investors’ funds and raise their potential returns. Indeed, across the industry, lower-cost funds have historically outperformed higher-cost funds on a net-of-expenses basis1.

Vanguard’s mission is to take a stand for all investors, to treat them fairly and to give them the best chance for investment success. With these fee reductions, we take our mission one step further. We expect the cuts to save investors approximately USD 3.5 million annually2. Vanguard offers the lowest-cost fixed income ETF range on average in Europe3.

The following ETFs will have their fees reduced on 1 July:

The enduring role of fixed income

Vanguard remains committed to making fixed income more accessible to investors. Our research suggests a supportive backdrop for bonds in the coming years, and we expect fixed income to play an increasingly important role in investor portfolios.

Bonds are notable for their ability to act as a portfolio buffer when volatility strikes. Fixed income exposures generally exhibit lower volatility than equities, and hedged global bonds in particular have consistently stood out as effective shock absorbers. We believe this role as a portfolio buffer will continue to serve investors well during periods of heightened turbulence.

As a further reflection of Vanguard’s focus on bonds as key portfolio building blocks, earlier this year we launched new ETFs offering investors exposure to euro-denominated government and corporate bonds and global government bonds.

In May 2025, Vanguard celebrated its 50th anniversary – and fixed income represents a meaningful part of our heritage. As a global leader in fixed income, Vanguard’s Fixed Income Group (which launched in 1981) manages more than USD 2.474 trillion globally, leveraging deep expertise to deliver precise benchmark tracking, prudent risk management and competitive performance.

Important information

Data provided by Morningstar is property of Morningstar and Morningstar’s data providers and it should therefore not be copied or distributed. Morningstar and its data providers are not responsible for any certification or representation with respect to data validity, certainty, or accuracy and are therefore not responsible for any losses derived from the use of such information.

The sale of the VAGU, VDTA, VDTY, VDEA, VDET, VECA, VECP, V3RE, VDPA and VDCP qualifies as a private placement pursuant to section 2 of Uruguayan law 18.627. Vanguard represents and agrees that it has not offered or sold, and will not offer or sell, any VAGU, VDTA, VDTY, VDEA, VDET, VECA, VECP, V3RE, VDPA and VDCP to the public in Uruguay, except in circumstances which do not constitute a public offering or distribution under Uruguayan laws and regulations. Neither the VAGU, VDTA, VDTY, VDEA, VDET, VECA, VECP, V3RE, VDPA and VDCP nor issuer are or will be registered with the Superintendency of Financial Services of the Central Bank of Uruguay to be publicly offered in Uruguay.

The VAGU, VDTA, VDTY, VDEA, VDET, VECA, VECP, V3RE, VDPA and VDCP correspond to investment funds that are not investment funds regulated by Uruguayan law 16,774 dated 27 September 1996, as amended.

Investment risk information

The value of investments, and the income from them, may fall or rise and investors may get back less than they invested.

Some funds invest in emerging markets which can be more volatile than more established markets. As a result the value of your investment may rise or fall.

ETF shares can be bought or sold only through a broker. Investing in ETFs entails stockbroker commission and a bid-offer spread which should be considered fully before investing.

Funds investing in fixed interest securities carry the risk of default on repayment and erosion of the capital value of your investment and the level of income may fluctuate. Movements in interest rates are likely to affect the capital value of fixed interest securities. Corporate bonds may provide higher yields but as such may carry greater credit risk increasing the risk of default on repayment and erosion of the capital value of your investment. The level of income may fluctuate and movements in interest rates are likely to affect the capital value of bonds.

The Funds may use derivatives in order to reduce risk or cost and/or generate extra income or growth. The use of derivatives could increase or reduce exposure to underlying assets and result in greater fluctuations of the Fund's net asset value. A derivative is a financial contract whose value is based on the value of a financial asset (such as a share, bond, or currency) or a market index.

Some funds invest in securities which are denominated in different currencies. Movements in currency exchange rates can affect the return of investments.

For further information on risks please see the “Risk Factors” section of the prospectus on our website.

1 See, for example, Considerations for index fund investing, Vanguard, 2024.

2 Source: Vanguard calculations, as at 23 June 2025. The calculation is based on the impact of the OCF reductions based on current AUM levels and would apply to any investors who are invested in the affected UCITS ETFs.

3 Source: Morningstar data, as at 23 June 2025.

4 Source: Vanguard, as at 23 June 2025.