Changes related to our model enhancements include:

- Increases in expected returns for U.S. stocks, which were driven by a reduction in the extent of valuation contraction we forecast based on forward-looking fair-value estimates.

- A depreciating U.S. dollar relative to most major currencies, including the euro and the yen, though we expect less strengthening in these other currencies than we did before.

- Lower forecasted returns from unhedged foreign equity investments, because of the combination of the above factors.

Among our forecast changes related to market movements in the first quarter, domestic equities in local currency terms were boosted by material valuation contractions in the U.S., Japan, Canada, and Australia.

A fuller discussion of our methodology enhancements, as well as our forecasts of annualized asset class returns and volatility levels over 10-year and 30-year horizons, is available on our economics and markets hub.

United States

The anticipated impact of tariffs and related policy uncertainty led us recently to lower our forecast of economic growth and increase our forecasts for unemployment and inflation.

We now expect:

- Full-year 2025 economic growth of less than 1%, down by a percentage point. Real-time signals point to a material slowdown in GDP growth in the first quarter.

- Inflation of nearly 4% this year.

- Two interest rate cuts (each 0.25 percentage point) by the Federal Reserve in the second half of 2025, leaving its target for short-term rates at 3.75%–4%. That’s 0.25 to 0.5 percentage point higher than most market participants are pricing in for year-end.

- A year-end unemployment rate of about 5%, up from our prior forecast of 4.5%. In March, unemployment stood at 4.2%.

Canada

The Bank of Canada has paused its interest rate-cutting cycle, but we forecast a couple more rate cuts by year-end.

We expect:

- Full-year 2025 economic growth of about 1.25%, down by 0.5 percentage point from our prior outlook.

- Full-year core inflation of about 2.5%, up from our previous forecast of 2.2%. Price increases of core items, which exclude volatile food and energy components, eased to 2.4% year over year in March.

- A year-end Bank of Canada policy rate of 2.25%, down from the bank’s current target of 2.75%. We don’t foresee a worst-case scenario for tariff implementation, which would allow policymakers to be dovish in the face of slowing economic growth.

- A year-end unemployment rate of about 7%, up from 6.7% in March.

Euro area

The region faces economic challenges due to elevated tariffs and related uncertainty, which are likely to counteract the gains from German fiscal stimulus.

We expect:

- Economic growth in 2025 of less than 1% and growth next year of about 1%. We anticipate that the effective tariff rate on euro area goods will rise to around 15% this year, which would pull down economic growth.

- Core inflation, which excludes food, energy, alcohol, and tobacco prices due to their volatility, to end 2025 just below 2%. Such prices were up 2.4%, on a year-over-year basis, in March.

- The European Central Bank to cut policy rates twice this year, to a year-end rate of 1.75%. Its current deposit facility rate is 2.25%.

- An unemployment rate of about 6.5% at year-end, up from the current record low of 6.1%, in February.

United Kingdom

The economy is facing challenging domestic forces, with core inflation falling more slowly than expected and the labor market deteriorating.

We expect:

- Economic growth in 2025 of about 0.5%, modestly lower than our prior forecast. Our outlook had already reflected a deterioration in forward-looking data, particularly for the labor market. Tax hikes, still-restrictive monetary policy, and a softening external environment are all weighing on demand.

- Core inflation to fall to around the central banks 2% target in 2026. Core prices, which exclude food, energy, alcohol, and tobacco due to the volatility of their prices, were 3.4% higher in March than one year earlier.

- The Bank of England to cut the bank rate quarterly, leaving it at 3.75% at year-end. It is 4.5% today.

- The unemployment rate to end the year around 4.8%, up from 4.4% for the December-through-February period.

Japan

An upward wage-price spiral leaves intact our view that the Bank of Japan will continue its gradual rate-hiking cycle, even amid elevated trade uncertainty.

We expect:

- Declining price competitiveness and weaker U.S. demand for Japanese goods to dent Japan’s economic growth by half a percentage point in 2025, leaving full-year growth of less than 1%.

- Steady wage growth on the back of strong corporate profits and structural labor shortages to support a recovery in domestic consumption and keep core inflation robust at around 2% this year. Core inflation excludes fresh food prices.

- The Bank of Japan to raise its policy rate (currently 0.5%) to 1.0% by year-end. However, amid heightened trade uncertainty, risks of a lower year-end policy rate are growing.

China

China's economy had a strong first quarter, but the global trade environment suggests challenges ahead.

We expect:

- Full-year 2025 economic growth just above 4%, with risks to the downside. We previously forecast 4.5% growth. We foresee the Politburo meeting this month as an opportunity for the announcement of supportive policy measures. But we don’t expect such measures to fully offset U.S. tariffs.

- Full-year core inflation of about 0.5%, and headline inflation to be even lower. Although food represents about 30% of China’s Consumer Price Index and the price of imported agricultural products could rise, that would likely be offset by energy and commodities prices pressured lower amid slowing global growth.

- On the monetary policy front, a 0.3 percentage point cut to the central bank’s seven-day reverse repo rate and 0.5 point of cuts to banks’ reserve requirement ratios.

Australia

We have advanced our expectation for the timing of the next Reserve Bank of Australia rate cut, from the third quarter to May.

We expect:

- Full-year 2025 economic growth of about 2%, with risks tilting to the downside.

- Trimmed mean inflation of about 2.5% at year-end, with downside risk due to global growth.

- The central bank to cut the policy cash rate target by 0.25 percentage point at its May 20 meeting, with a year-end policy rate of 3.5%.

- The unemployment rate to rise to about 4.5% this year amid still-restrictive interest rates.

Mexico

Recent economic conditions in Mexico have been negatively affected by trade-related uncertainty, leading to an economic contraction in the fourth quarter of 2024.

We expect:

- Economic growth of less than 1% this year, down from our previous forecast of a range of 1.25%–1.75%.

- Core inflation of about 3.5% in 2025, above the midpoint of the central bank’s 2%–4% target range.

- The central bank to continue its easing cycle, with the rate ending 2025 in a range of 8%–8.25%.

Asset class return outlooks

Vanguard has updated its 10-year annualized outlooks for broad asset class returns through a March 31, 2025, running of the Vanguard Capital Markets Model® (VCMM). The probabilistic return assumptions depend on market conditions and change with each running over time. The updated forecasts additionally reflect enhancements to the VCMM methodology itself. These changes are reflected in our forecasts for the first time. The methodology enhancements include:

- A global core model that better captures relationships across regions and diversification benefits for investment portfolios.

- Dynamic equity valuation forecasts based on forward-looking fair value estimates, informed by long-term views on the macroeconomic environment.

- The capturing of revenue growth trends and cyclicality of profit margins in a time-varying earnings growth model.

- Currency forecasts based on economic fundamentals, with consideration of current overvaluation or undervaluation, rather than the more traditional method based on differences between interest rates.

- Policy rate views from Vanguard’s economics research team as additional inputs on the short end of the yield curve.

- These enhancements more holistically reflect real-world asset return drivers and allow for more detailed discussions of the economic and financial environment associated with our return forecasts.

- Some forecasts have changed notably from what we communicated based on a December 31, 2024, running of the VCMM. Related to our model enhancements, factors include:

- Developed markets outside the U.S., in local currency terms, have higher equity return forecasts than they would have had under the old model, but emerging markets have lower expected returns than they would have had under the old model, driven by changes in how we model equity valuation and earnings growth.

- Increased U.S. equity expected returns are driven by less projected valuation contraction based on forward-looking fair-value estimates.

- The new model forecasts a depreciating U.S. dollar relative to most major currencies (including the euro and the yen), though these other currencies are expected to strengthen less than under the previous model. For U.S. based investors, the combination of the factors above produces a net effect of lower forecasted returns from unhedged foreign equity investments.

- Expected fixed income returns by maturity categories vary by degrees, given our inclusion of Vanguard economists’ policy rate views.

Among the highlights related to market movements in the first quarter, domestic equities in local currency terms were boosted by material valuation contractions in the U.S., Japan, Canada, and Australia.

We communicate the Investment Strategy Group’s updated numbers at least quarterly. We will provide the next update based on an April 30, 2025, running of the VCMM, given heightened volatility after U.S. tariff announcements. You can find up-to-date U.S. return forecasts, U.S. asset class valuations, and timevarying asset allocation on the econ and markets hub. (These pages will be updated by Friday, April 25, for the March 31, 2025, running of the VCMM.)

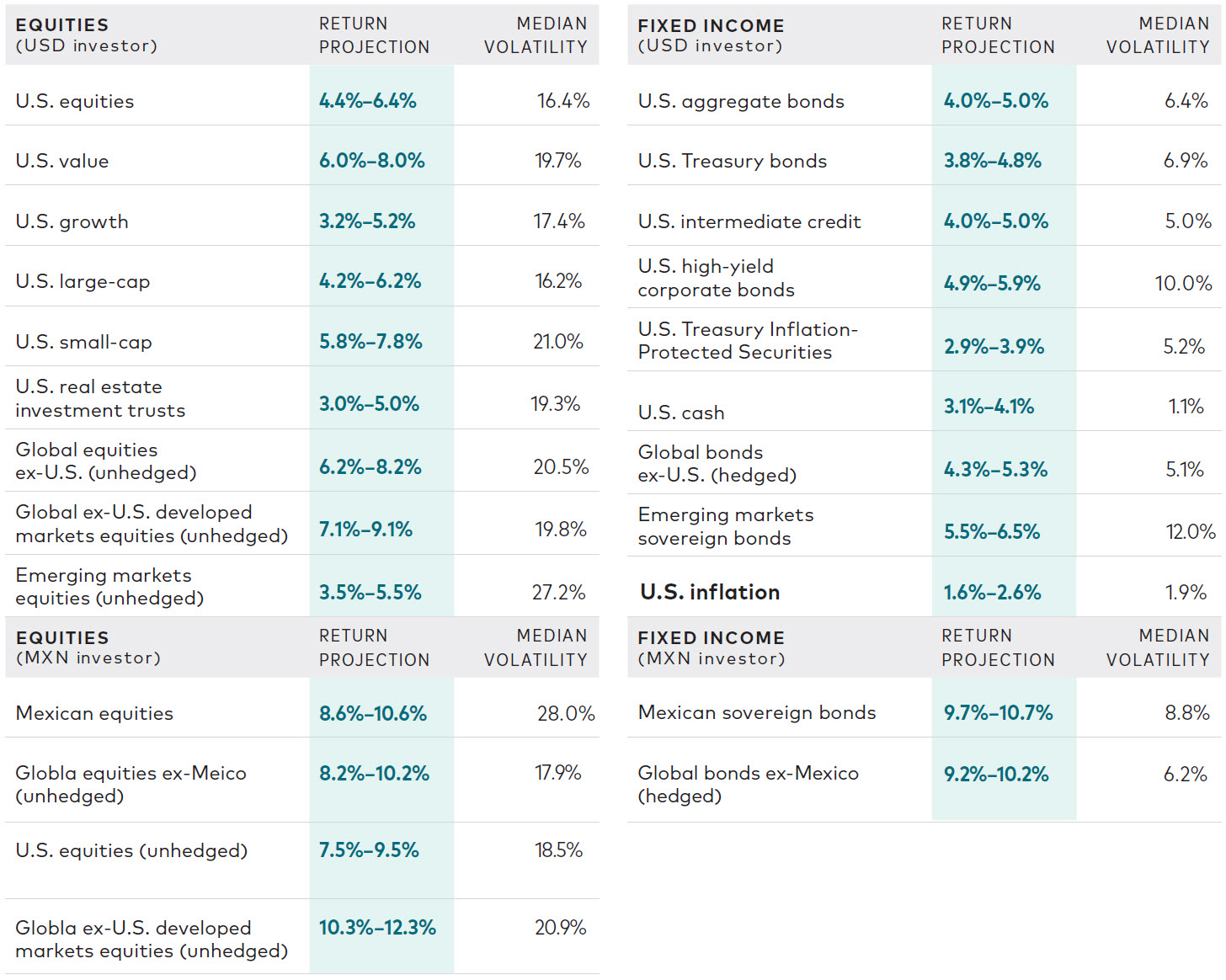

Our 10-year annualized nominal return projections, expressed for local investors in local currencies, are as follows. The figures are based on a 2-point range around the 50th percentile of the distribution of return outcomes for equities and a 1-point range around the 50th percentile for fixed income. Numbers in parentheses reflect median volatility.

Notes:

- All investing is subject to risk, including the possible loss of the money you invest.

- Investments in bonds are subject to interest rate, credit, and inflation risk.

- Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

- This document is not intended to provide tax advice or make and exhaustive analysis of the tax regime of the securities described herein. We strongly recommend seeking professional tax advice from a tax specialist.